The Schengen Area refers to a group of countries, most of which are part of the European Union, that allow free movement within their shared borders. If you can get a visa to one such country, you can visit them all, making the Schengen Area appealing for tourists and immigrants alike. However, there’s a catch: Depending on your nationality and how long you plan on staying, you need special insurance to qualify for a visa.

One choice that meets the visa requirements is AXA Schengen insurance. The AXA certificate is accepted at all embassies and consulates representing the 26 countries of the Schengen Area. You’ll receive a certificate as soon as you purchase your travel insurance online.

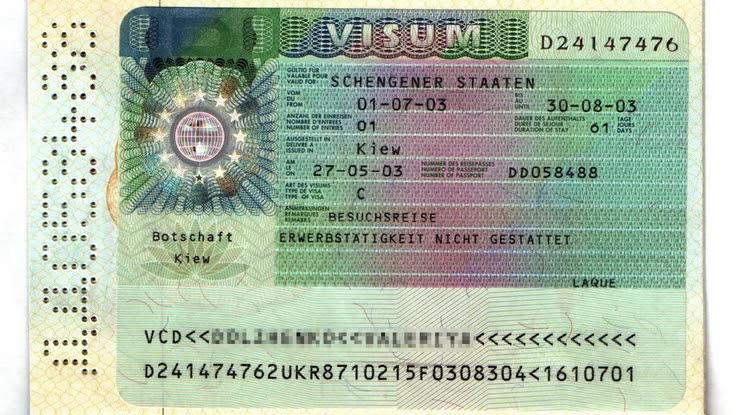

What Is a Schengen Visa?

The Schengen Area countries are Austria, Denmark, Belgium, Germany, Estonia, Spain, Greece, Hungary, France, Finland, Italy, Iceland, Latvia, Lithuania, Liechtenstein, Malta, Norway, Luxembourg, Poland, Portugal, the Netherlands, the Czech Republic, Sweden, Switzerland, Slovenia and Slovakia, with Bulgaria, Croatia and Romania are in the process of joining. While citizens of these countries can move freely between them, most non-Europeans require a visa to gain access.

Short-term visas, which allow visitors to stay in the Schengen Area for 90 days over a period of six months, are the most popular. However, citizens of the United States, Canada, Mexico, Japan, Australia and Brazil don’t need one as long as their stay is less than 90 days due to an agreement signed with the European Union.

What Is AXA Schengen Health Insurance?

AXA is a French insurance company that has since expanded to offer services across Europe, North America, India and more. Each of AXA’s Schengen Area plans covers medical care, hospitalization, sanitary repatriation (return for treatment in your home country if needed) and even the return of your remains should you perish overseas. Just be sure to call AXA Assurance — the sub-branch of AXA that deals with Schengen insurance — before paying any medical bills to ensure that you’re covered. One policy must be taken out for each traveler. In the event that your visa is declined, you can ask for a refund.

While people from the United States and other countries that can visit for up to 90 days without a visa do not need AXA Schengen insurance, it can still be useful for unexpected emergencies. This is especially true if you plan on doing something dangerous, like rock climbing in the Alps. Although medical costs are significantly lower in Europe compared to the United States, a bill for a serious injury can still be an unpleasant vacation surprise.

What Price Options Exist?

AXA offers three Schengen insurance plans. The most basic option is AXA Low Cost Travel Insurance, which costs about €20 for a week. The plan includes coverage of up to €30,000 (approximately $33,000) within the Schengen Area and is valid for up to 180 consecutive days, twice the length of a short-term visa.

The other two plans, Europe Travel and Multi-Trip, cover not just the Schengen Area, but also San Marino, Andorra, the Vatican and Monaco. After Brexit, AXA also decided to extend coverage in the United Kingdom through the end of 2020. Both plans offer coverage up to €100,000 (about $111,000). The difference is that Europe Travel lasts for 180 consecutive days, making it better for families on vacation, while Multi-Trip provides annual coverage (the length of your stay is still limited by your visa or the 90 day limit, but your coverage is not), making it a better choice for frequent travelers to Europe. The Europe Travel plan costs €30 ($33) for a week, while Multi-Trip is €298 ($328) for a year.